- Life is Rich Roundup

- Posts

- Smart strategies for staying on track with retirement savings during holiday spending

Smart strategies for staying on track with retirement savings during holiday spending

Welcome back to Life is Rich! It's all snowstorm warnings, Christmas Specials, and, of course, gearing up for the holidays. With so many important retail events on top of each other, it's hard to keep track of disposable income and savings. Join us as we delve into your finances to ensure your retirement savings are still on track and how to enjoy all that glitters during the festivities.

Before we slice into this newsletter, we have some exciting news to share! Savvly is officially launching in 2025, and we want you there beside us as we unveil disruptive retirement as you've never seen it before. Sign up for our waiting list to be the first to know.

Smart strategies for staying on track with retirement savings during the holiday spending

It comes as no surprise that the season of giving translates to the season of spending, and according to a report by CNBC, shoppers are expected to for over $1,778 this holiday season. Those who don't have this in savings likely will rack up some credit card debt. The kicker is that nearly 28% of credit card users are still paying off last year's holiday debt. The more debt we have, the less likely we are to keep on track with our long-term savings plans, such as retirement savings. Here are a few simple tricks to not get carried away this coming festive season:

Automate your savings: If you're worried about using the money meant for your retirement savings for something else, automate your payments to ensure that no matter what, your installments are paid first.

Use a budget: Plan out how much you want to spend on each holiday event, down to the meals and gifts. If possible, buy gifts, ingredients, and decor in advance to avoid getting stuck with expensive items no one else wants.

Ask yourself whether it would make a difference: Do you really need another set of string lights or another decoration on the lawn? Do you have to prepare all the dishes, or can other family members bring their own specialty dishes? Wanting to do it all is admirable, but not if it lands you in debt. In fact, research by Civic Science reveals that 14% of respondents indicated that they would go into debt this year just to purchase holiday gifts.

Use your year-end bonus wisely. Instead of buying things that will only last for the holiday season, pay off high-interest debt or increase your savings and investments.

Boost your investment portfolio this December

While we're on the topic of gifting, why not put your money to good use and buy investments instead of another grill or appliance? Some of the picks might include:

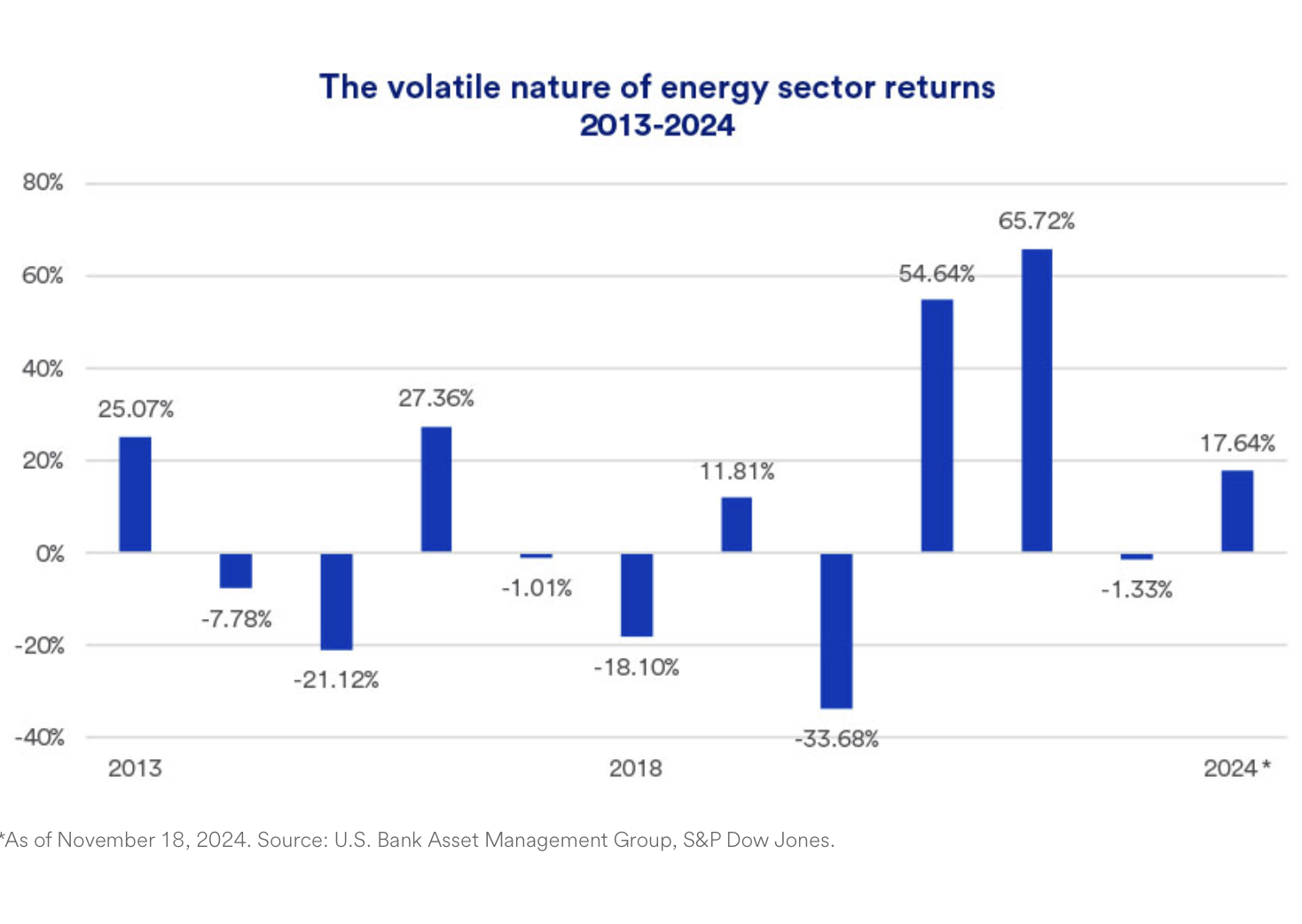

Energy Stocks

From gas to oil, energy stocks offer attractive yields year-on-year if you're willing to ride out the volatility of the markets. According to U.S. Bank, the S&P Energy sector gained 17.64% year-on-year despite its volatile nature.

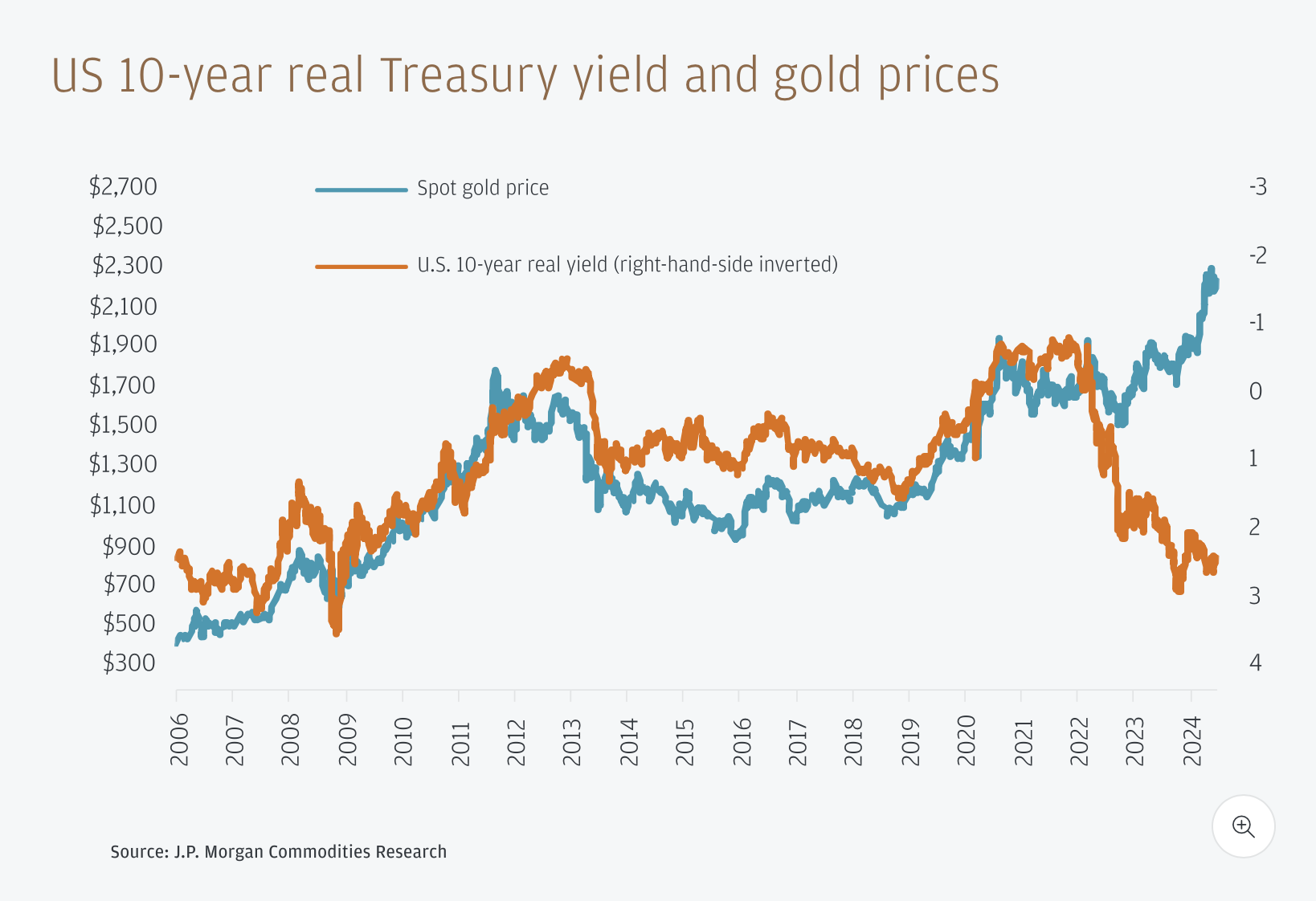

Gold

Just as with energy stocks, gold offers growth over a period of time, if you're willing to overlook its short-term volatility. Regarded as a safe-haven asset, gold is still a valuable asset to include in a balanced investment portfolio.

Pavlova, the trending Christmas dessert for 2024

While pavlova might not be well-known as a Christmas dessert in the northern hemisphere, it's certainly starting to take its place on trending Christmas dinner tables this year. It's versatile and fresh and works well with cream, chocolate, fruits, and nuts, all must-have ingredients for an indulgent pudding.

We like this option from Food & Wine, which combines pillowy and flavorful pavlova with a holiday favorite, pistachio. The dessert is constructed in the shape of a Christmas wreath and includes fresh raspberries and chocolate bark. Drool!

Spread the cheer this year with charitable giving

Christmas is not only a time for generosity toward your loved ones. In fact, statistics show that 30% of annual charitable giving happens in December and 10% of that in the last three days of the year. No shortage of charitable organizations could use your support, from war relief efforts to natural disaster relief. If you want to donate locally, consider shelters and food banks.

The good & bad news of the week

The Good News

The Bad News

Exciting announcement!

Consider this our gift to you: We have something big coming in January! Sign up for our waitlist to get early access to the next exciting Savvly product launch.

Savvly blog

Switching jobs can be an exciting time full of new possibilities and even a possible pay rise. But what happens to your 401(k)? Our blog titled What to Do With Your 401(k) When You Switch Jobs answers this and gives you some insightful tips to make the most of the switch.

Links you might've missed

Before we go

Happy Holidays from Savvly!