- Life is Rich Roundup

- Posts

- Are we in a retirement crisis? What rising inflation means for your golden years

Are we in a retirement crisis? What rising inflation means for your golden years

Welcome back to another installment of Life is Rich. We're covering a hot topic in this newsletter and no, it's not whether a pumpkin-spiced latte is a fall gimmick. No, we're talking about rising inflation rates and how to weather the financial side of Thanksgiving this year.

We're excited to have you as an early supporter of Savvly. As we prepare for launch, we're on a mission to build the most helpful personal pension platform possible – and we need your insights. Would you take 5 minutes to share your thoughts about retirement in our quick survey? As one of our earliest supporters, your input will directly shape the features we prioritize for launch.

How inflation affects your retirement

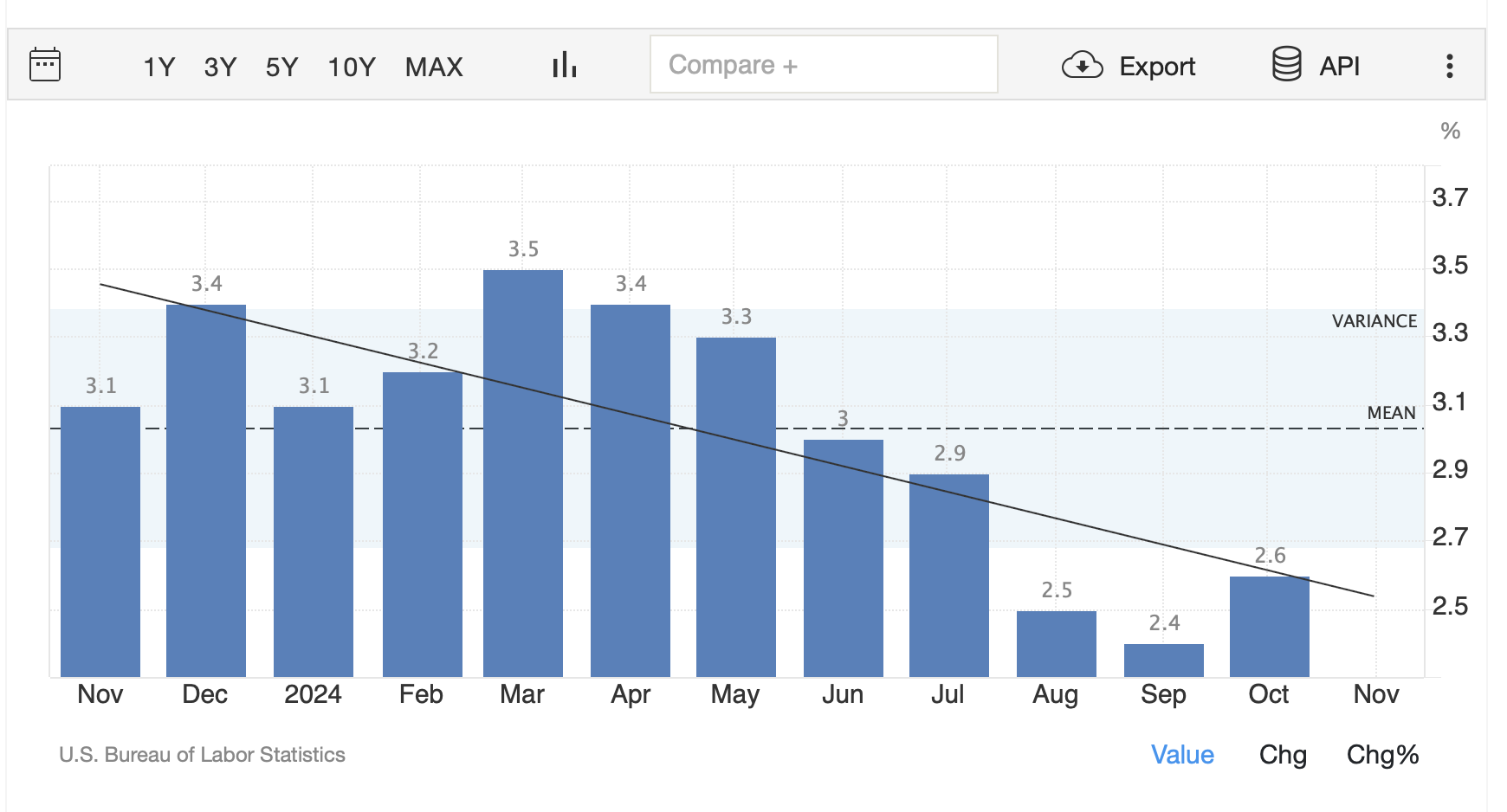

Inflation rates in the US have slowed down from the peak at 3.5% in March 2024, to the lowest for the year at 2.4% in September. However, a worrying uptick in inflation happened in November when it jumped back up to 2.6%, ending the downward trajectory. This is a blow for Americans who expected the rates to drop more before the holidays, especially considering how inflation affects interest rate decisions. Reports show that the component that will feel the biggest pinch is energy, where prices are expected to increase.

So how does this affect retirees? If you're looking to retire in the next year or two, you might have substantially less buying power than if you were to retire after the inflation drops and stabilizes. One of the key things to consider is that your savings and investments should always outperform inflation to ensure that you're not out of pocket at retirement. If possible, try to push out retirement a little longer to ride out high inflation.

Dropping interest rates

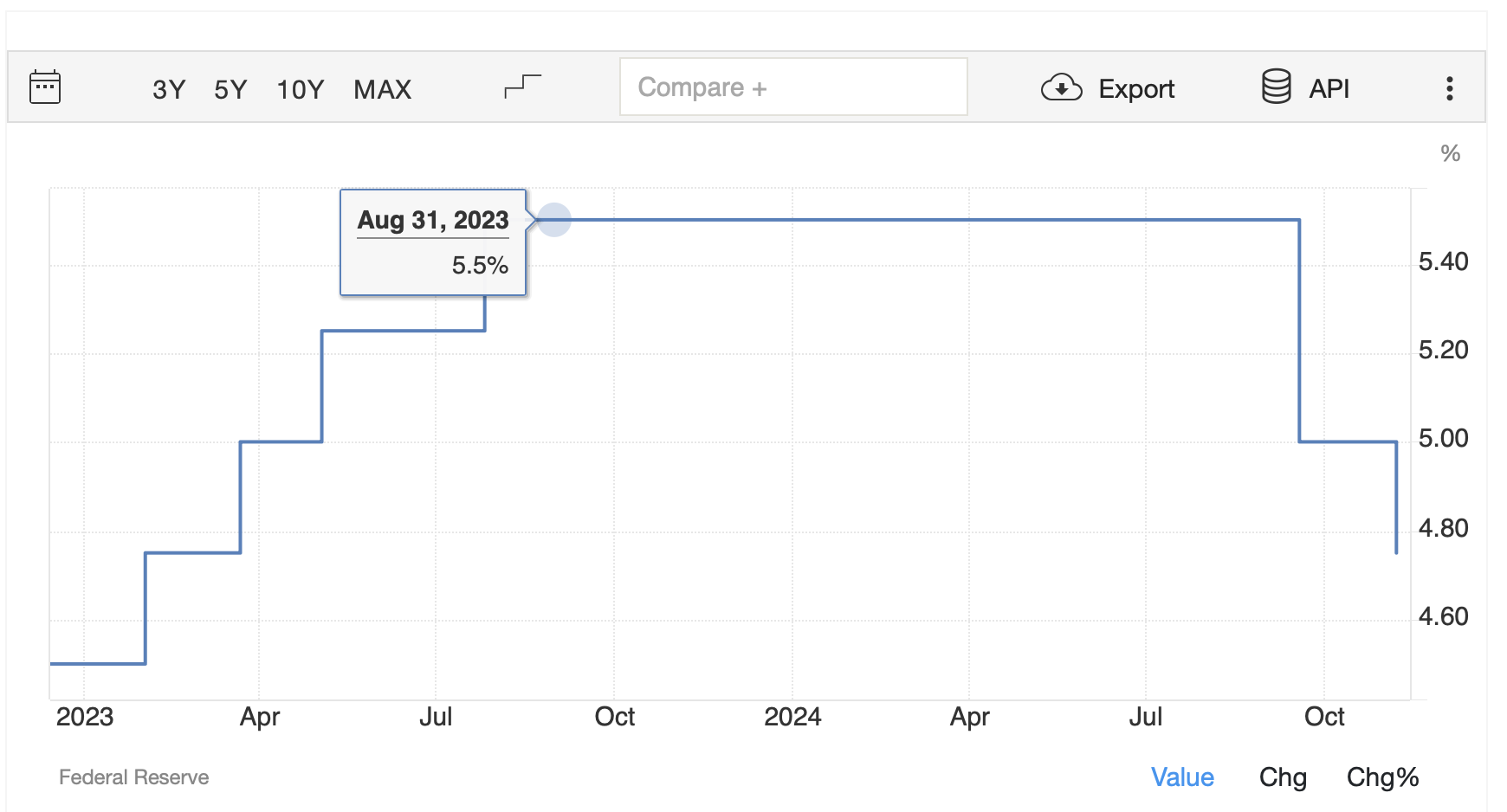

Indebted Americans may feel some relief this December as economists predict that the Fed will cut interest rates. They predict a drop of 0.25% and while the expectation was for a bigger drop, this comes hot on the heels of a surprising rise in inflation. What this means for the consumer is a slight relief on their pockets, but not too much, or else inflation just becomes a runaway train.

If the interest rate doesn't drop, this simply means that the Fed aims to curb spending ahead of the new year and that consumers will need to tighten their belts. The uncertainty regarding the interest rate cut will slow down holiday spending, which will affect key retail events such as Thanksgiving and Black Friday.

The pumpkin spice debate

The minute that first leaf starts turning color and there's a slight chill in the evening air, you can bet that local and major coffee chains have unlocked the vault to take out the super secret, seasonal pumpkin spice latte recipe. While for many, the first whiff of the cinnamon-and-coffee combo induces a strange phenomenon that can only be described as the fall lull, it also manages to irk those who believe that the beloved spiced comfort drink is just a marketing gimmick, tricking Americans into spending their hard-earned cash on something that's not more special than just a few extra spices and a syrup squirt or two. Are you team PSL or would you rather stick with your year-round blend?

Investment strategies feel the boost

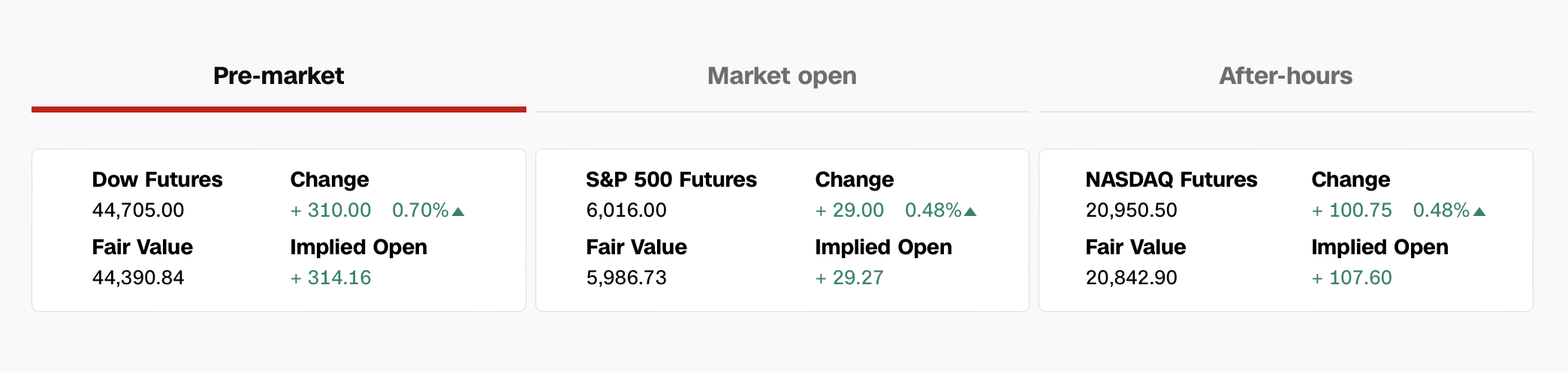

Americans are celebrating a decent bull market of late, with president-elect Donald Trump announcing his cabinet. The two-year run has seen some terrific performances from all three futures (Dow, S&P500 and Nasdaq). Yields on Treasury bonds were a tremendous boost for the markets, thanks to Trump's view on fiscal policies.

Source: CNN Business 11-25-2024

The good news and bad news of the week

The good news

MSCI's global equities gauge rose and U.S. government bonds rallied while the dollar fell on Monday as investors welcomed the incoming U.S. president's selection of fund manager Scott Bessent as the next U.S. Treasury secretary.

The bad news

After a massive run up through to mid-July, US stocks appear to suddenly be under immense selling pressure. The media is full of reports of impending doom and gloom, and the usual bearish mouthpieces are taking the recent decline as vindication of their “the sky is about to fall” narrative.

Exciting announcement

Savvly is proud to announce the official launch of Savvly in early 2025. This means only a few months left until we can help you shape a pension plan that works for you. Simply sign up for the waitlist to be the first to know all about this exciting launch.

Savvly blog

If you're a fan of scrolling and happen to have a few financial-savvy influences on your feed, chances are good some of them might have actually helped you kickstart a good financial habit or two. Join us as we delve deeper into social media finance tips and how this can help shape (or destroy!) a retirement strategy in our blog post, How Social Media Influences Our Financial Decisions (and How to Get Back on Track).

Links you might have missed

Before we go

Happy Thanksgiving and we hope you remember those extra roomy sweatpants!